Your cart is currently empty!

Mortgage Calculations: Building Transparency in Real Estate Financing

- Understanding the Basics of Mortgage Calculations

- Why Real-Time Accuracy Matters

- Common Mortgage Questions That Drive User Searches

- Building a User-Friendly Mortgage Calculation Tool

- Integrating the TAGLAB Mortgage API

- Conclusion: Upgrading Transparency with TAGLAB Mortgage APIs

- Frequently Asked Questions

Understanding the Basics of Mortgage Calculations

A mortgage payment typically comprises four core components: principal, interest, taxes, and insurance—often abbreviated as PITI. The principal is the amount borrowed, and interest is the cost of borrowing that money over time. Property taxes and insurance are either included in monthly payments (escrow) or paid separately, depending on the loan’s structure and local regulations.

When users search for “how to calculate mortgage payments accurately” or “best mortgage calculator for first-time buyers,” they often seek clarity on how changing any one factor—like the interest rate or down payment—impacts the final monthly amount. Even minor shifts in the interest rate can add up to thousands of dollars in savings or extra costs over the life of the loan, underscoring the need for precise estimates.

Why Real-Time Accuracy Matters

Mortgage rates can fluctuate daily or even multiple times within a single day, influenced by broader economic indicators such as inflation, employment data, and central bank policies. As a result, displaying static or outdated figures can mislead users and erode trust in your platform. Queries such as “latest mortgage interest rates” or “today’s mortgage rate trends” underscore the demand for timely data.

By integrating real-time mortgage rate data, you offer visitors the most up-to-date information possible—often the deciding factor in whether they initiate or delay a purchase or refinance. When homebuyers see live rate updates, they’re more likely to believe your content is credible and revisit your site for further guidance.

Common Mortgage Questions That Drive User Searches

People exploring home loans frequently have pointed queries, including:

- “How much will I pay each month?” – A straightforward question that hinges on loan term, interest rate, and down payment.

- “What is the total interest over my mortgage’s lifetime?” – Amortization schedules reveal how interest adds up over time, a significant concern for budgeting.

- “How do I compare a 15-year vs. 30-year mortgage?” – Shorter terms often mean higher monthly payments but lower total interest paid.

- “Does a larger down payment help me avoid private mortgage insurance (PMI)?” – A key question for those looking to reduce overall monthly costs.

Addressing these concerns in your content and tools effectively taps into user intent, capturing valuable search traffic and enhancing your site’s authority on real estate financing topics.

Building a User-Friendly Mortgage Calculation Tool

Today’s users expect calculators that not only offer quick estimations but also deliver practical insights:

- Simplicity: Clear labels and intuitive fields (e.g., “Home Price,” “Interest Rate,” “Down Payment”) are critical for first-time buyers.

- Adjustable Parameters: Allowing users to toggle interest rates, compare different loan terms, or add optional expenses like HOA fees can help them gauge multiple scenarios.

- Transparent Outputs: Displaying not just monthly payments, but also total interest, amortization breakdown, and potential PMI or escrow costs sets your tool apart from generic calculators.

- Mobile Responsiveness: Many searches—like “mortgage calculator on phone”—indicate a need for a layout that adapts seamlessly to smaller screens.

By catering to these expectations, you create a tool that resonates with both novices and experienced homebuyers, increasing the likelihood that users will share or return to your platform.

Integrating the TAGLAB Mortgage API

APIs (Application Programming Interfaces) offer a direct pipeline to real-time, authoritative data. By using the TAGLAB Mortgage API, you can automate updates to rates and other metrics without manual intervention. This ensures that users always see current numbers—boosting credibility and user satisfaction.

Additionally, this approach enables more advanced features, such as side-by-side loan comparisons, region-specific property tax calculations, or dynamic updates when market conditions shift.

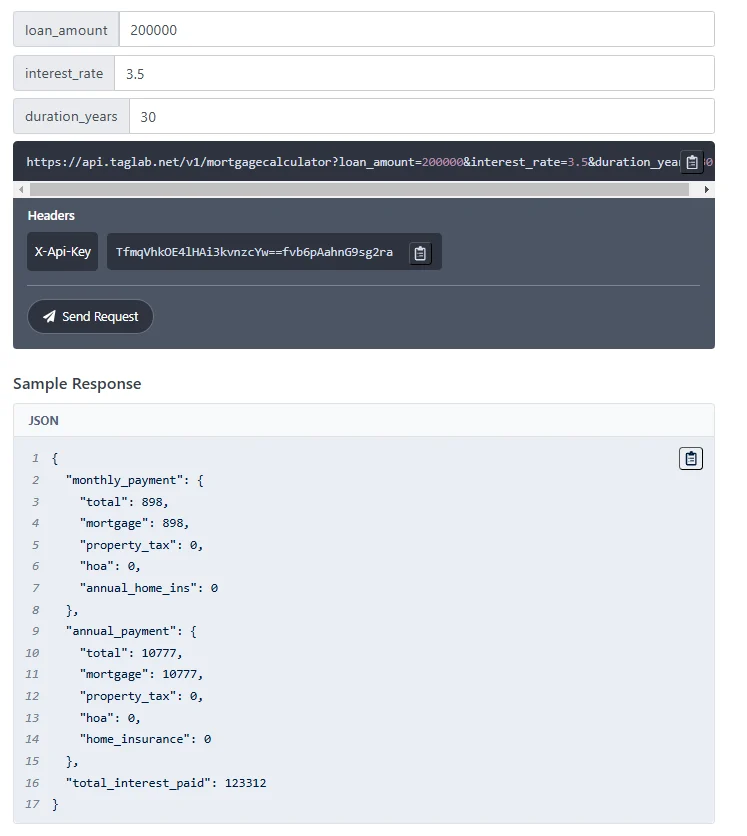

API Request & Response Example

Here, you might show how your platform sends a request to the TAGLAB endpoint, specifying parameters like loan amount, interest rate type, and property location. These inputs ensure the returned data aligns closely with the user’s specific scenario.

Once your request is processed, the server delivers a structured response—often in JSON format—with up-to-date mortgage rates, estimated payments, or even amortization details. Displaying this information accurately is critical for user trust.

Once your request is processed, the server delivers a structured response—often in JSON format—with up-to-date mortgage rates, estimated payments, or even amortization details. Displaying this information accurately is critical for user trust.

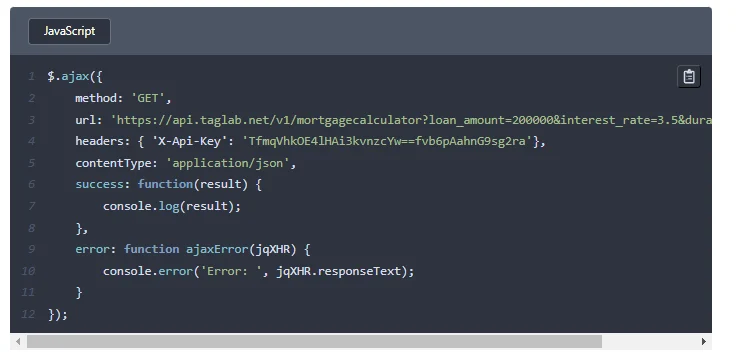

Using the API in Your Code

If you’re implementing the API on a website, a snippet written in any language can handle tasks like parsing the response and updating your calculator’s fields in real time. This not only keeps users engaged but also showcases transparency, as they see the direct impact of changing inputs like interest rate or loan term.

If you’re implementing the API on a website, a snippet written in any language can handle tasks like parsing the response and updating your calculator’s fields in real time. This not only keeps users engaged but also showcases transparency, as they see the direct impact of changing inputs like interest rate or loan term.

Conclusion: Upgrading Transparency with TAGLAB Mortgage APIs

Mortgage calculations can feel complex, especially when interest rates shift and new fees come into play. By focusing on clarity in your content and leveraging real-time data, you empower users to make well-informed decisions. Whether someone is trying to compare a 15-year versus 30-year loan or gauge how a slightly higher down payment can remove PMI, they’ll appreciate accurate, intuitive tools that simplify the process.

With TAGLAB Mortgage APIs, you elevate your platform from a static information repository to a dynamic resource capable of delivering timely, data-driven insights. This boost in transparency not only meets the expectations of today’s market-savvy audience but also positions your site as a trusted partner in their home financing journey.

Frequently Asked Questions

What does a mortgage calculator show besides monthly payments?

A well-rounded mortgage calculator can detail your principal vs. interest breakdown, the total interest you’ll pay over the life of the loan, and additional escrow items like property taxes or homeowner’s insurance. This added clarity helps users see the real cost of homeownership.

Why is real-time data essential for accurate mortgage estimates?

Mortgage rates and market conditions can shift daily, so real-time data ensures you’re providing up-to-date figures. This reduces the risk of inaccurate estimates that might lead buyers to make poorly timed decisions, like locking in a loan under unfavorable terms.

Is technical expertise needed to use the TAGLAB Mortgage API?

Basic familiarity with APIs can help, but TAGLAB provides straightforward documentation to guide even novice developers. With a few simple steps, you can embed real-time mortgage rates and calculations into your website or platform with minimal fuss.

What unique advantages do TAGLAB Mortgage APIs offer?

Besides reliability and ease of integration, TAGLAB Mortgage APIs allow for advanced features like side-by-side loan comparisons, real-time rate adjustments, and customized amortization breakdowns. This level of detail not only educates users but also builds trust in your platform’s ability to offer comprehensive mortgage solutions.